When it comes to utilizing the value of your home for financial purposes, two common options are reverse mortgages and home equity loans or Home Equity Lines of Credit (HELOCs). Both approaches allow homeowners to tap into their home’s equity, but they have distinct features, eligibility criteria, and potential consequences.

In this article, we’ll delve into the differences between reverse mortgages and home equity loans/HELOCs, helping you make an informed choice based on your individual circumstances.

Read More: Jumbo vs. Conventional Loans

Understanding Reverse Mortgages

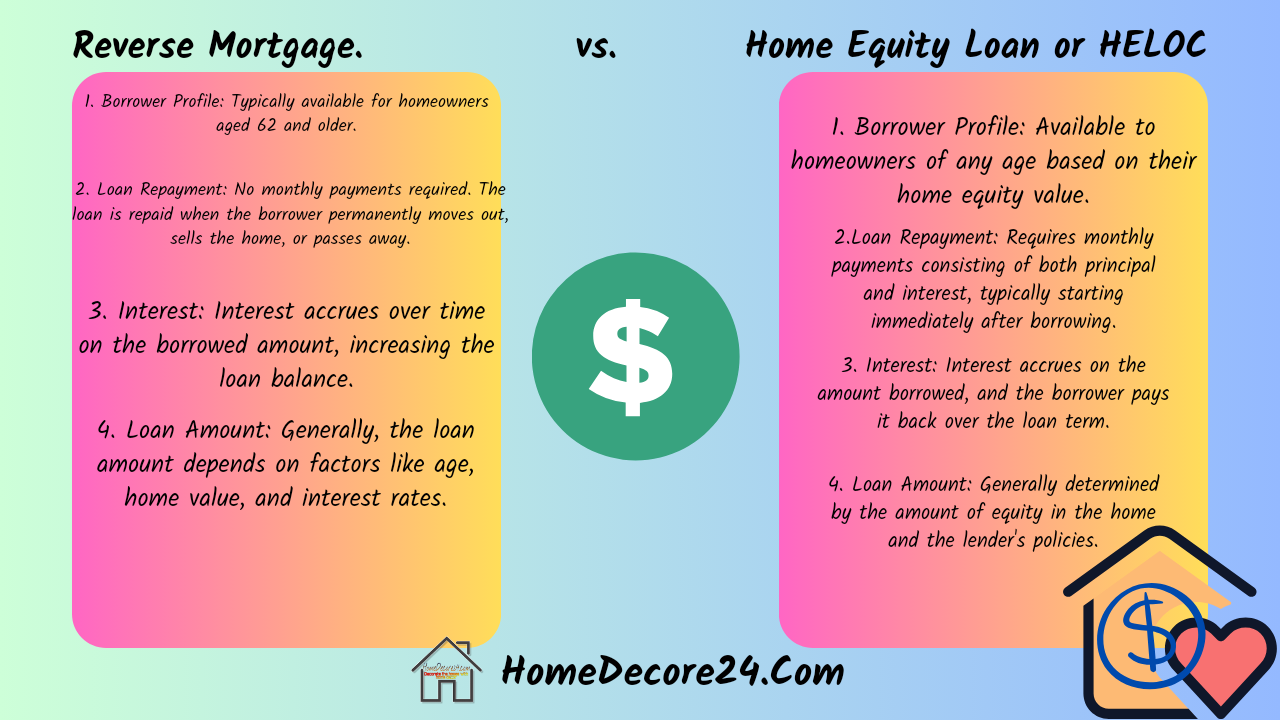

A reverse mortgage is a unique financial product designed for homeowners aged 62 and older. Unlike traditional mortgages where borrowers make monthly payments to the lender, a reverse mortgage works in the opposite way. Instead of making payments, the lender provides funds to the homeowner, which can be taken as a lump sum, fixed monthly payments, a line of credit, or a combination of these options.

The distinguishing feature of a reverse mortgage is that it doesn’t need to be repaid as long as the homeowner continues to live in the home. The loan is repaid, with interest, when the homeowner moves out, sells the home, or passes away. This means that the loan balance can increase over time, potentially impacting the amount of equity left for heirs.

Reverse mortgages can provide financial flexibility for retirees, allowing them to supplement their income, cover medical expenses, or undertake home renovations. However, there are specific eligibility criteria, including age and home equity requirements. Additionally, it’s important to consider the associated fees and interest rates, as they can vary between lenders.

Exploring Home Equity Loans and HELOCs

Home equity loans and HELOCs are more traditional options for tapping into your home’s equity. They involve borrowing a lump sum (home equity loan) or a line of credit (HELOC) secured by your home’s value. These options are available to a broader range of homeowners, not restricted by age, but they do require a good credit score and a certain level of equity in the home.

Home Equity Loan

With a home equity loan, you receive a lump sum of money upfront, which you repay in fixed monthly installments over a set period, typically at a fixed interest rate. This can be advantageous for individuals who have a specific expense in mind, like home improvements or consolidating high-interest debts, as the fixed terms provide predictability.

HELOC (Home Equity Line of Credit)

A HELOC provides you with a revolving line of credit that you can draw from over a specific period, known as the draw period. During this period, you can borrow, repay, and borrow again, much like a credit card. After the draw period ends, a repayment period begins, during which you can’t borrow any more funds and must start repaying the borrowed amount with interest.

Read More: The 40-Year Mortgage

Choosing the Right Option

The decision between a reverse mortgage and a home equity loan/HELOC depends on your financial goals, circumstances, and preferences. Consider these factors:

Age and Eligibility

Reverse mortgages are limited to older homeowners, while home equity loans/HELOCs have broader eligibility criteria.

Financial Goals

If you need a steady stream of income or a safety net for retirement expenses, a reverse mortgage might be suitable. If you have a specific expense in mind and prefer a one-time lump sum, a home equity loan could be a better fit.

Equity Preservation

If you’re concerned about leaving your home’s equity to your heirs, a home equity loan/HELOC might be preferable, as the loan balance won’t necessarily increase over time.

Interest Rates and Fees

Compare the interest rates, fees, and terms associated with each option to determine the most cost-effective choice.

Long-Term Plans

Consider your plans for the home. If you intend to stay in the home for the long term, a reverse mortgage might align with your goals. If you’re planning to sell or move in the near future, a home equity loan/HELOC might be more appropriate.

Risk Tolerance

Reverse mortgages come with the risk of decreasing home equity over time, while home equity loans/HELOCs involve fixed payments, providing more predictability.

Who is the Best?

The best choice between reverse mortgages, home equity loans, and HELOCs depends on your age, financial goals, and home ownership plans. Seek professional advice for personalized guidance.

Read More: Assumability of VA Loans

FAQ’s

What are the 3 types of reverse mortgages?

The three types of reverse mortgages are Home Equity Conversion Mortgage (HECM), Proprietary Reverse Mortgage, and Single-Purpose Reverse Mortgage, each with specific eligibility and features.

What is the major disadvantage of reverse mortgage?

A major disadvantage of reverse mortgages is the potential reduction in home equity over time, impacting the inheritance left for heirs and their financial prospects.

Youtube Video

Bottom Line

Reverse mortgages, home equity loans, and HELOCs each have their own advantages and considerations. Before making a decision, carefully evaluate your financial needs, future plans, and comfort level with the associated risks.

Consulting with a financial advisor or housing counselor can provide personalized guidance tailored to your situation, ensuring you make the choice that best aligns with your goals and circumstances.

✓ Government Home Loans and More