When it comes to financing a home, most people are familiar with the standard 30-year fixed-rate mortgage. However, there is another option gaining popularity in recent years – the 40-year mortgage. This longer-term loan offers both advantages and disadvantages that prospective homebuyers should carefully consider before making a decision.

What is A 40 Year Mortgage?

A 40-year mortgage is a long-term home loan that extends the typical 30-year repayment period by an additional decade. This mortgage structure offers lower monthly payments, making homeownership more accessible for some borrowers. However, it also means paying more in interest over the loan’s extended term and slower equity accumulation, impacting the overall cost and timing of home ownership.

Read More: What is an fha loan and how does it work

Can you get a 40 Year Mortgage?

Yes, some lenders offer 40-year mortgages as an alternative to traditional 30-year loans. However, their availability may vary depending on your location and the lending institution’s policies.

How does a 40 Year home loan work?

A 40-year home loan functions like a standard mortgage but with an extended repayment term. Borrowers make monthly payments over 40 years, resulting in lower monthly installments but higher overall interest costs.

What lenders offer a 40 Year Mortgage?

Lenders offering 40-year mortgages may vary by region and change over time. It’s advisable to check with a range of financial institutions, including banks, credit unions, and mortgage brokers, to see if they currently provide this option and inquire about their specific terms and eligibility criteria.

The Benefits of 40 Year Mortgages?

The main benefits of 40-year mortgages are lower monthly payments, increased affordability, and improved cash flow. These extended-term loans can make homeownership more accessible to some buyers, especially in high-cost areas, by spreading out the loan balance over a longer period.

Read More: Types of VA Loans

The downside of 40 Year Mortgages?

The disadvantages of 40-year mortgages include higher overall interest costs due to the extended term, slower equity buildup, and a prolonged debt obligation, potentially impacting financial flexibility during retirement. Additionally, not all lenders offer these loans, limiting borrower options and potentially affecting interest rates and terms.

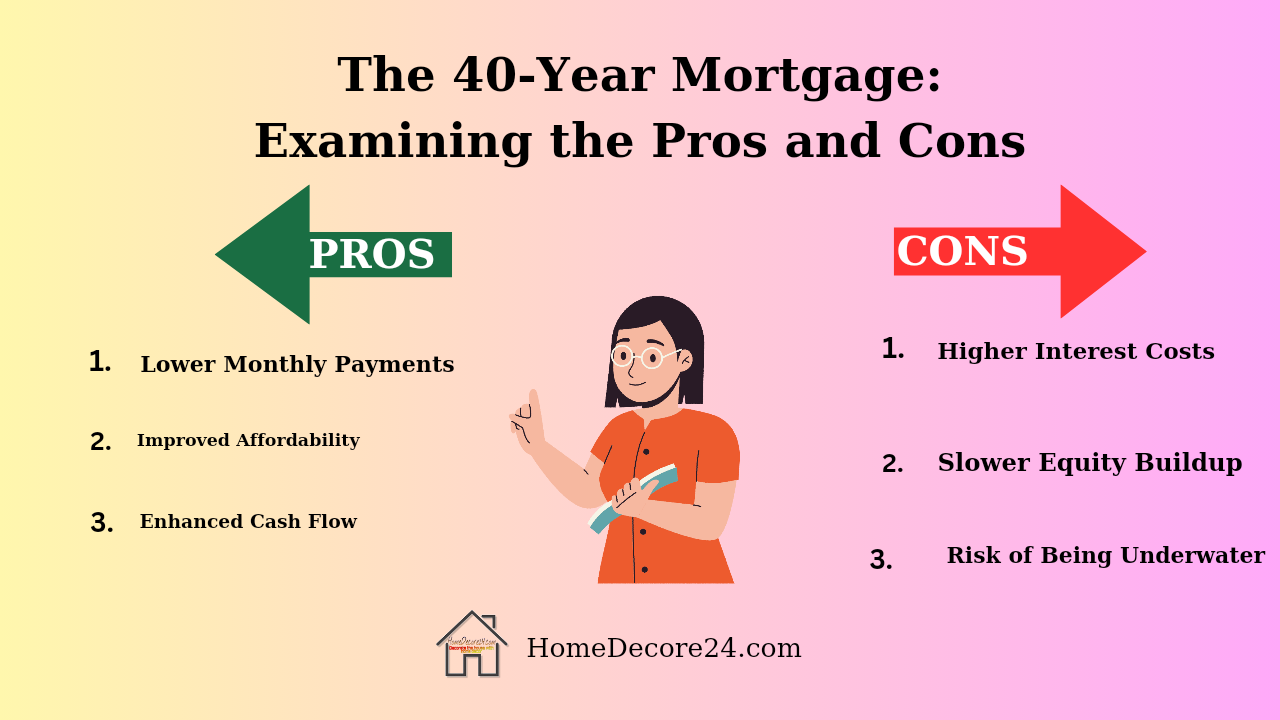

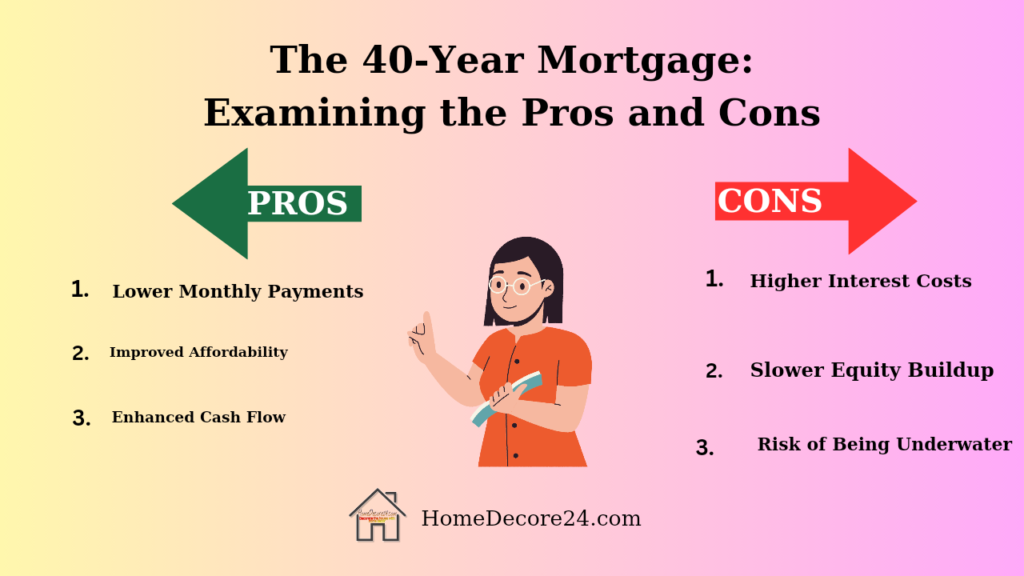

Pros And Cons of 40 Year Mortgage

Pros of a 40-Year Mortgage

Lower Monthly Payments

One of the most significant advantages of a 40-year mortgage is the lower monthly payments it offers. By extending the repayment term by ten years compared to a traditional 30-year mortgage, borrowers can spread their loan balance over more time, reducing the monthly financial burden.

Improved Affordability

The lower monthly payments make homeownership more accessible to those who might not otherwise qualify for a mortgage. This can help individuals and families purchase homes in high-cost areas where real estate prices are steep.

Enhanced Cash Flow

With lower monthly mortgage payments, borrowers can free up more of their income for other purposes, such as investing, saving for retirement, or paying off high-interest debt. This improved cash flow can provide financial flexibility.

Potential Tax Benefits

Depending on your circumstances and the tax laws in your region, a 40-year mortgage might offer tax advantages. Consult with a tax professional to determine if you can benefit from mortgage interest deductions.

Read More: USDA Guarantee Fees

Cons of a 40-Year Mortgage

Higher Interest Costs

The extended loan term means you’ll pay more in interest over the life of the loan compared to a shorter-term mortgage. This can substantially increase the total cost of homeownership.

Slower Equity Buildup

Because a larger portion of your monthly payments goes toward interest rather than principal in the early years of the loan, building equity in your home takes longer. It may take several years before you start seeing significant equity accumulation.

Risk of Being Underwater

With slower equity buildup, there’s a higher risk of owing more on your home than it’s worth (being underwater) for an extended period. This can be particularly problematic if property values decline.

Limited Lender Options

Not all lenders offer 40-year mortgages, so you may have limited choices when it comes to selecting a lender and securing a competitive interest rate.

Prolonged Debt Obligation

Committing to a 40-year mortgage means carrying mortgage debt well into your retirement years. This extended debt obligation can limit your financial freedom during retirement.

FAQ’s

Is there such thing as a 40 Year Mortgage?

Yes, 40-year mortgages exist as a real financial product, although they may not be as widely available as traditional 30-year mortgages.

Is 40 Year Mortgage a good idea?

A 40-year mortgage can be beneficial for some, offering lower monthly payments, but it’s essential to weigh it against the higher interest costs and prolonged debt commitment.

What is 40 Year fixed interest only?

A 40-year fixed interest-only mortgage is a loan where the borrower pays only the interest for 40 years, not reducing the principal, resulting in lower monthly payments but no equity buildup.

Youtube Video

Bottom Line

The 40-year mortgage can be a useful financial tool for some homebuyers, offering lower monthly payments and increased affordability. However, it’s essential to weigh these benefits against the higher interest costs, slower equity buildup, and other potential drawbacks.

Before choosing this extended loan term, carefully evaluate your financial goals, long-term plans, and the real cost of homeownership. Consider consulting with a financial advisor to determine if a 40-year mortgage aligns with your overall financial strategy. Ultimately, the decision should be based on your individual circumstances and preferences.

✓ Prenuptial Agreements and Mortgages