With a rich history in the US financial services industry, Wells Fargo is a massive player. But is Wells Fargo the best bank for you when there are so many other alternatives available? Everything you need to know will be covered in detail in this review.

Today we are going to review Wells Fargo Bank. We have been working in finance for the last 2 years. You can read many types of finance related things on our website. homedecore24.com will continue to share with you every finance related knowledge. Please become our family.

Wells Fargo History

A Rich Past: A Look Back at Wells Fargo’s Past

The name Wells Fargo is well-known and is often associated with banking in the US. However, its past goes much beyond internet banking and ATMs. Let’s explore this financial behemoth’s intriguing past:

From the Gold Rush to the Banking Monarchy

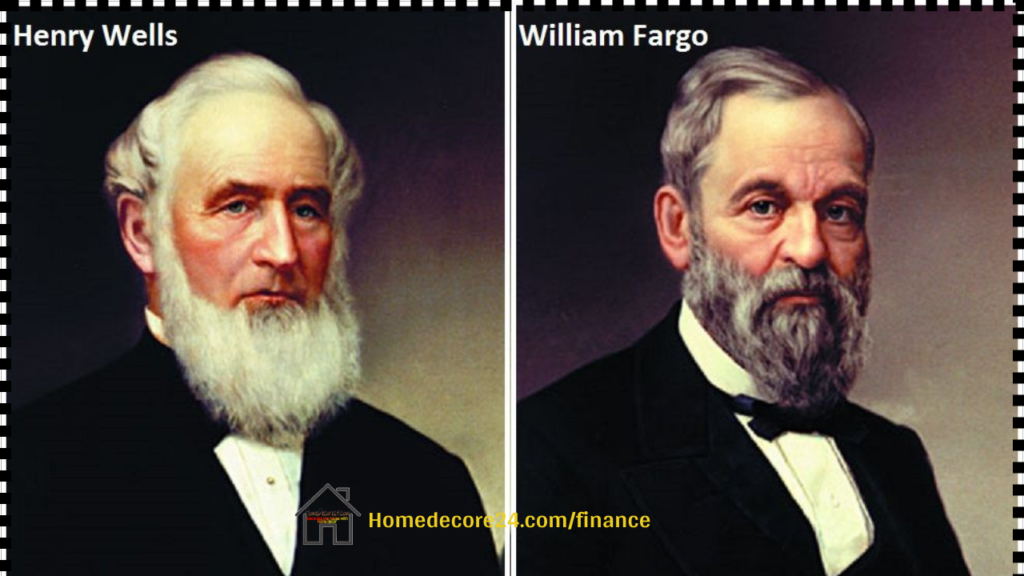

- 1852: Co-founders of American Express Henry Wells and William Fargo introduce the tale. Acknowledging the promise of the California Gold Rush, they founded Wells, Fargo & Company to offer banking and expedited shipping services.

- Stagecoach Days: Their specialization became moving mail, jewels, and gold dust throughout the American West. The famous stagecoaches of Wells Fargo came to represent dependability in a perilous frontier.

- Banking Expansion: Wells Fargo increased the scope of its banking offerings as the West progressed. They were crucial in providing funding for companies and railroads, which promoted economic expansion.

- Separation & Mergers: The business separated its banking and express divisions in 1905. Wells Fargo maintained its growth throughout the years by merging with other notable companies, securing its place as a top bank.

The Contemporary Period

Innovation & Technology: To adapt to a changing environment, Wells Fargo welcomed technology breakthroughs by providing online banking and mobile deposits.

Disputations: A controversy about millions of fictitious accounts that were made by workers in order to reach inflated sales targets surfaced in 2016. The event seriously tarnished Wells Fargo’s image.

Wells Fargo Founder

Wells Fargo was established via a partnership between two merchants rather than by a single individual:

- Henry Wells: With his background in express delivery services, Henry Wells was a founder member of American Express.

- William G. Fargo: William Fargo was another co-founder of American Express, and his experience complimented Wells’s. He also held many terms as Buffalo, New York’s mayor.

Together, they saw the potential created by the California Gold Rush in 1852 and founded Wells, Fargo & Company. This business would develop into the current Wells Fargo.

Wells Fargo CEO

Charles W. Scharf is the CEO of Wells Fargo at the moment. In October 2019, he took on the position. Scharf is a seasoned leader in the financial services industry who has led organizations such as Bank of New York Mellon and Visa Inc.

- CEO: Wells Fargo’s current CEO is Charles Scharf.

- Pay: Scharf received $29 million in total salary in 2023. This featured a sizable bonus and equity incentive plan in addition to a basic salary of $2.5 million.

Wells Fargo Market Value

Wells Fargo has a substantial market share. Its market worth is estimated to be $202 billion in total. It is among the most valuable corporations in the world because to this astounding statistic.

Wells Fargo Share Price

The closing price of Wells Fargo’s shares on March 27, 2024, was $57.03 USD. This indicates a marginal rise of 0.62% from the day’s beginning price. It’s crucial to remember that this is only a snapshot of the closing price and that share prices can change during the trading day. You can check investing platforms or financial news websites for the most recent information.

Wells Fargo first entered the stock market at USD 1.30 on Mar 30, 1984. Which gradually kept increasing and one day its share reached 65.93 USD Jan 26, 2018.

Wells Fargo Totle Branch

More than 7,800 branches: According to recent studies, this number is frequently claimed.

Wells Fargo Good Or Bad

Like any financial organizations, Wells Fargo has advantages and disadvantages to take into account. Here’s a summary to assist you in determining whether it’s a suitable fit:

Good for:

- Convenience: Wells Fargo provides simple access to your funds through a large (although declining) branch network and an intuitive mobile app.

- Whole Suite of goods: They provide a whole range of goods, such as mortgages, loans, investment opportunities, and checking and savings accounts.

- National Recognition: For certain consumers looking for a reputable and well-known bank, their well-known brand offers piece of mind.

Things to Be Aware Of:

- costs: Wells Fargo is known for charging a number of costs, including as overdraft fees and monthly account maintenance. Make sure you look into the particular costs connected to the account you choose.

- 2016 Scandal: In 2016, a significant scandal involving millions of fictitious accounts damaged their brand. Despite their efforts to do better, keep in mind their past.

- Reduced Interest Rates: Wells Fargo usually gives lower interest rates on CDs and savings accounts than internet banks do.

Is wells fargo considered a good bank?

Pros:

Broad distribution: Convenient access to your funds is provided via a robust mobile app and an extensive branch network, notwithstanding its shrinkage.

Offering a wide range of services: Offers a complete line of products, such as savings accounts, loans, mortgages, and investment opportunities.

Well-known brand: Some consumers find comfort in the recognized moniker.

Cons:

Fees: Distinguished by a range of fees, including overdrafts and regular maintenance. For the account you choose, find out about the relevant costs.

Previous controversy: Despite making improvements, their image was damaged by the 2016 bogus account scam.

Lower interest rates: When compared to internet banks, this provider often provides lower interest rates on CDs and savings accounts.

How safe is wells fargo bank?

Wells Fargo is regarded as secure since the FDIC insures your deposits up to $250,000 per account type. That implies you will not lose your insured funds in the event of a bank failure.

Which is no. 1 bank of USA?

JPMorgan Chase is the top bank in the United States based on asset size.

Is wells fargo better than bank of america?

* Convenience & Branch Access: Bank of America has a bigger ATM network, while Wells Fargo has more branches.

* costs: In order to avoid costs, Wells Fargo may have somewhat lower minimum balance requirements than the other bank.

* Interest Rates: Online banks often provide interest rates that are greater than those of Bank of America or Wells Fargo.

YouTube Video

Read More