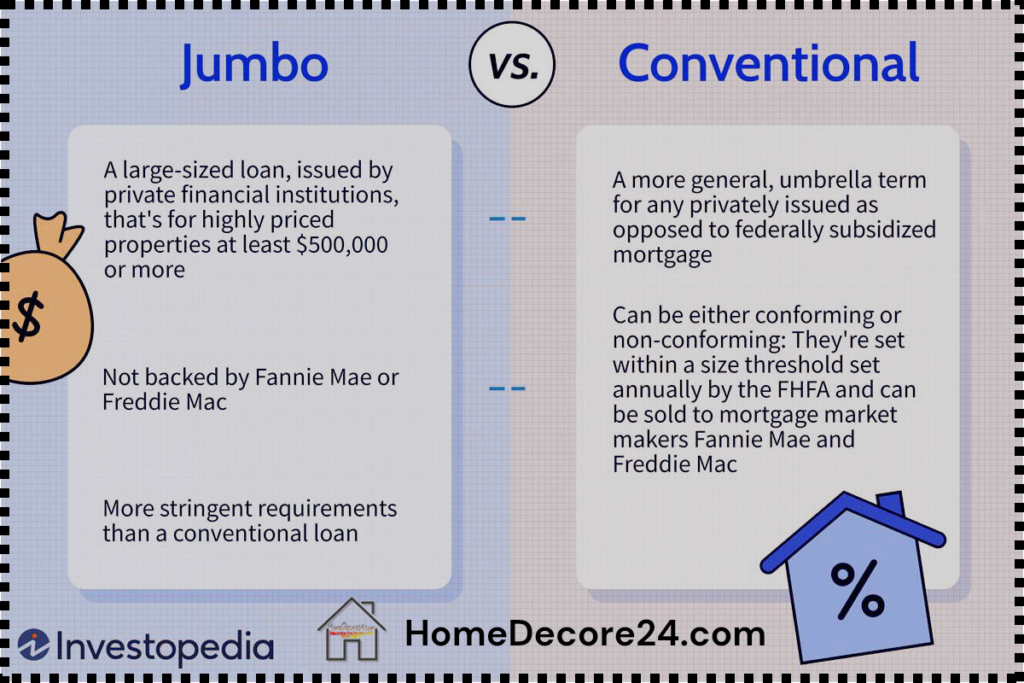

In the realm of real estate financing, individuals seeking to purchase or refinance homes often encounter the terms “jumbo loans” and “conventional loans.” These two types of loans are popular choices for borrowers but cater to different financial scenarios and have distinct characteristics. This article aims to provide a comprehensive understanding of jumbo and conventional loans, highlighting their differences and key features.

Is there a difference in a Jumbo loan vs. a conventional loan?

There are distinct differences between jumbo loans and conventional loans. Both serve as financial tools for homebuyers, but they cater to different borrowing needs and financial scenarios.

Read More: FHA Loan as a Self-Employed Individual

Loan Amount

- Jumbo Loan: The primary differentiator is the loan amount. Jumbo loans are designed for purchasing high-value properties that exceed the conforming loan limits set by government agencies. These properties are often located in upscale or expensive housing markets.

- Conventional Loan: Conventional loans adhere to the loan limits set by government-sponsored entities like Fannie Mae and Freddie Mac. These loans are suitable for properties within the specified limits, which can vary by location.

Qualification Requirements

- Jumbo Loan: Due to the larger loan amounts, jumbo loans usually come with stricter qualification criteria. Borrowers need higher credit scores, lower debt-to-income ratios, and a more substantial financial profile to be eligible.

- Conventional Loan: While conventional loans also have qualification criteria, they tend to be more lenient than jumbo loans. Borrowers with good credit and reasonable financial stability can often qualify.

Interest Rates

- Jumbo Loan: Jumbo loans generally have slightly higher interest rates compared to conventional loans. Lenders charge higher rates to compensate for the increased risk associated with larger loan amounts.

- Conventional Loan: Conventional loans typically come with lower interest rates due to their adherence to standardized guidelines and lower risk for lenders.

Down Payment

- Jumbo Loan: Borrowers seeking jumbo loans usually need a larger down payment compared to conventional loans. Lenders often require a higher percentage of the property’s value as a down payment to mitigate risk.

- Conventional Loan: Conventional loans offer more flexibility in terms of down payment. Borrowers can secure a loan with a down payment as low as 3% of the property’s purchase price, making homeownership more accessible.

Loan Process

- Jumbo Loan: The loan process for jumbo loans can be more intricate and time-consuming. Lenders meticulously scrutinize the borrower’s financial documents and require thorough verification of income, assets, and creditworthiness.

- Conventional Loan: Conventional loans have a more standardized loan process, often involving less documentation and a quicker approval process.

Private Mortgage Insurance (PMI)

- Jumbo Loan: Jumbo loans typically do not require private mortgage insurance (PMI) because of the larger down payments and lower loan-to-value ratios.

- Conventional Loan: Borrowers who put down less than 20% on a conventional loan are generally required to pay for PMI, which protects the lender in case of default.

What are conforming loan limits?

Conforming loan limits are maximum loan amounts set by government-sponsored entities like Fannie Mae and Freddie Mac. These limits determine the threshold for loans considered “conforming” and eligible for standardized guidelines. Loan limits vary by location and help regulate the mortgage market.

Read More: How to Recognize a Reverse Mortgage Scam

FAQ’s

What is the difference between a Jumbo loan and a conventional loan?

Jumbo loans are for high-value properties exceeding conforming loan limits, often with stricter criteria and higher rates. Conventional loans adhere to these limits with more flexibility.

Are Jumbo loan more expensive than conventional?

Yes, Jumbo loans tend to be more expensive than conventional loans due to higher interest rates and stricter qualification requirements associated with larger loan amounts.

What is the Jumbo limits for conventional loan?

The jumbo limit for conventional loans varies by location but generally starts around $548,250. It signifies the loan amount beyond which a jumbo loan is needed.

Why are Jumbo rates higher?

Jumbo rates are higher because these loans carry greater risk for lenders due to their larger loan amounts. Lenders charge more to offset the increased potential financial exposure.

How do I find a Jumbo loan lender?

To find a jumbo loan lender, research online, consult with local banks, credit unions, or mortgage brokers. They specialize in offering these larger loans and can guide you effectively.

How can I avoid a Jumbo loan?

To avoid a jumbo loan, consider properties within conforming loan limits. Additionally, make a larger down payment or explore cost-effective housing markets that align with conventional loan criteria.

Youtube Video

Bottom Line

In summary, the choice between a jumbo loan and a conventional loan depends on various factors such as the property’s location, the borrower’s financial situation, and the loan amount required. Jumbo loans are suited for high-priced real estate markets and cater to borrowers with strong financial profiles. Conventional loans, on the other hand, offer more flexibility in terms of loan limits, qualification criteria, and down payment options.

Understanding the differences between these two types of loans can empower borrowers to make informed decisions aligned with their housing and financial needs. Consulting with a knowledgeable mortgage professional is always advisable to determine the most suitable loan option based on individual circumstances.

✓ What’s The Role of a Stockbroker in Trading?