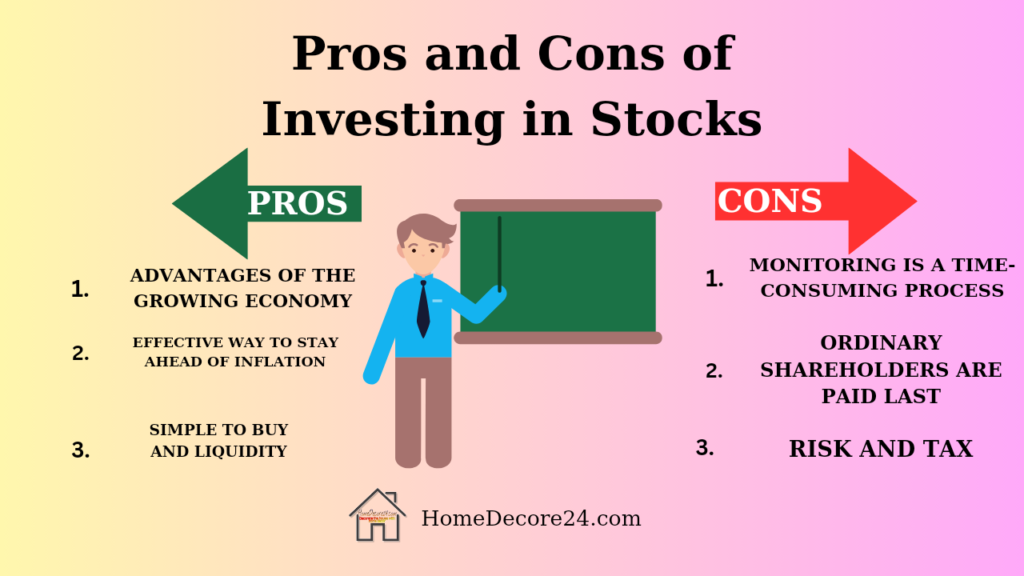

Investing in stocks can be a thrilling rollercoaster ride: moments of soaring highs and gut-wrenching lows, all intertwined with the potential for significant wealth growth. But before you jump on this exciting (yet sometimes precarious) journey, it’s crucial to understand the pros and cons of investing in stocks.

This comprehensive guide will equip you with valuable insights, market statistics, and a step-by-step approach to navigate the stock market responsibly and work towards your financial goals.

The Alluring Upsides of Stock Investing

High Growth Potential

Compared to safer options like savings accounts, stocks offer the chance for significantly higher returns, potentially outpacing inflation and growing your wealth over time.

Passive Income Powerhouse

Dividend-paying stocks offer regular income, like a mini paycheck from companies you own a piece of. Imagine earning extra income just by being part of a successful company!

Liquidity Advantage

Unlike real estate, stocks can be easily bought and sold on exchanges, providing quicker access to your invested funds when needed. This liquidity ensures you’re not locked into long-term commitments.

Ownership and Voting Rights

Owning stocks means owning a piece of the company, granting you voting rights in major decisions. You become an active participant in the company’s growth and direction.

Read More: What is an fha loan and how does it work

Reality Check: Things to Be Aware Of Before Diving In

Market Volatility: Remember, the potential for high returns comes hand-in-hand with the risk of losing money. Market downturns can significantly impact your portfolio value. Be prepared for the inevitable ups and downs of the market.

Time Horizon Matters: Building wealth through stocks takes time. While short-term gains are possible, long-term investment strategies tend to yield the best results. Think of it as planting a seed and nurturing it into a flourishing tree.

Knowledge is Power: Educating yourself about the market, analyzing companies, and understanding risk management are crucial for informed investment decisions. Don’t jump in blindly; equip yourself with the knowledge to make smart choices.

Step-by-Step Guide: From Stock Market Newbie to Savvy Investor

Define Your Goals

What are you hoping to achieve with your investments? Retirement, a down payment, or just long-term growth? Tailoring your strategy to your goals is key.

Assess Your Risk Tolerance

Can you handle market fluctuations without sleepless nights? Understanding your comfort level with risk helps navigate volatile periods.

Diversify, Diversify, Diversify

Don’t put all your eggs in one basket! Spread your investments across different industries and asset classes to minimize risk. Think of it as building a sturdy bridge with multiple pillars for support.

Don’t Panic Sell

Market dips are inevitable. Resist the urge to sell in a frenzy; consider long-term trends and your investment thesis before making decisions. Remember, emotional investing can be your worst enemy.

Seek Professional Help

If you’re a newbie, consider consulting a financial advisor for personalized guidance and portfolio management. Having a professional by your side can provide valuable insights and peace of mind.

Read More: Is wells fargo a good bank to bank with

Frequently Asked Questions

How much money do I need to start?

You can start with as little as $100! Many platforms offer fractional shares, allowing you to own a piece of a company even with limited funds. Every journey begins with a single step, and even small investments can grow over time.

What are the tax implications?

Capital gains earned from selling stocks are typically taxed, so be aware of the rates and potential tax strategies. Remember, consulting a financial advisor can help you navigate the tax complexities.

Is there a “magic formula” for success?

Unfortunately, no. While research and analysis can increase your chances of success, there’s no guaranteed path to riches. However, discipline, patience, and a long-term mindset are powerful tools for navigating the market.

Conclusion

Investing in stocks can be a powerful tool for building wealth, but it’s not a get-rich-quick scheme. Weigh the pros and cons carefully, educate yourself, and develop a sound investment strategy aligned with your risk tolerance and goals. Remember, patience, diversification, and a long.

✓ A Comprehensive Guide to the Types of VA Loans