Investing in an Airbnb rental property can be a lucrative endeavor, providing a steady stream of income and potential for long-term wealth. However, securing the necessary financing is a crucial step in turning your real estate dreams into reality. In this comprehensive guide, we will explore various financing options and strategies to help you successfully fund your Airbnb rental property.

What is Airbnb rental?

Financing your Airbnb rental involves securing funding, such as a mortgage or loan, to purchase or renovate a property for short-term rental purposes, aiming for profitability.

Understand Your Budget and Financial Goals

Before delving into financing options, it’s essential to assess your financial situation and establish clear goals. Determine your budget, including the down payment, property purchase price, and potential renovation costs. Consider your long-term financial objectives, such as desired monthly income and property appreciation.

Read More: Airbnb Rental FAQ

Traditional Financing Options

a. Conventional Mortgage: Securing a traditional mortgage through a bank or lending institution is a common way to finance an Airbnb rental. You’ll typically need a down payment of 20% or more and a solid credit score.

b. FHA Loan: If you’re a first-time investor, you might qualify for a Federal Housing Administration (FHA) loan, which requires a lower down payment but comes with certain restrictions.

c. Portfolio Loan: Some local banks or credit unions offer portfolio loans, which provide more flexibility in underwriting criteria, making them suitable for investors with unconventional income sources.

Creative Financing Strategies

a. Seller Financing: Negotiate with the property seller to arrange a financing agreement, where they act as the lender. This can be especially helpful if you’re struggling to secure a traditional loan.

b. Private Lenders: Explore private lending options, where individuals or groups provide the necessary funds. Private lenders may offer more lenient terms and faster approval processes.

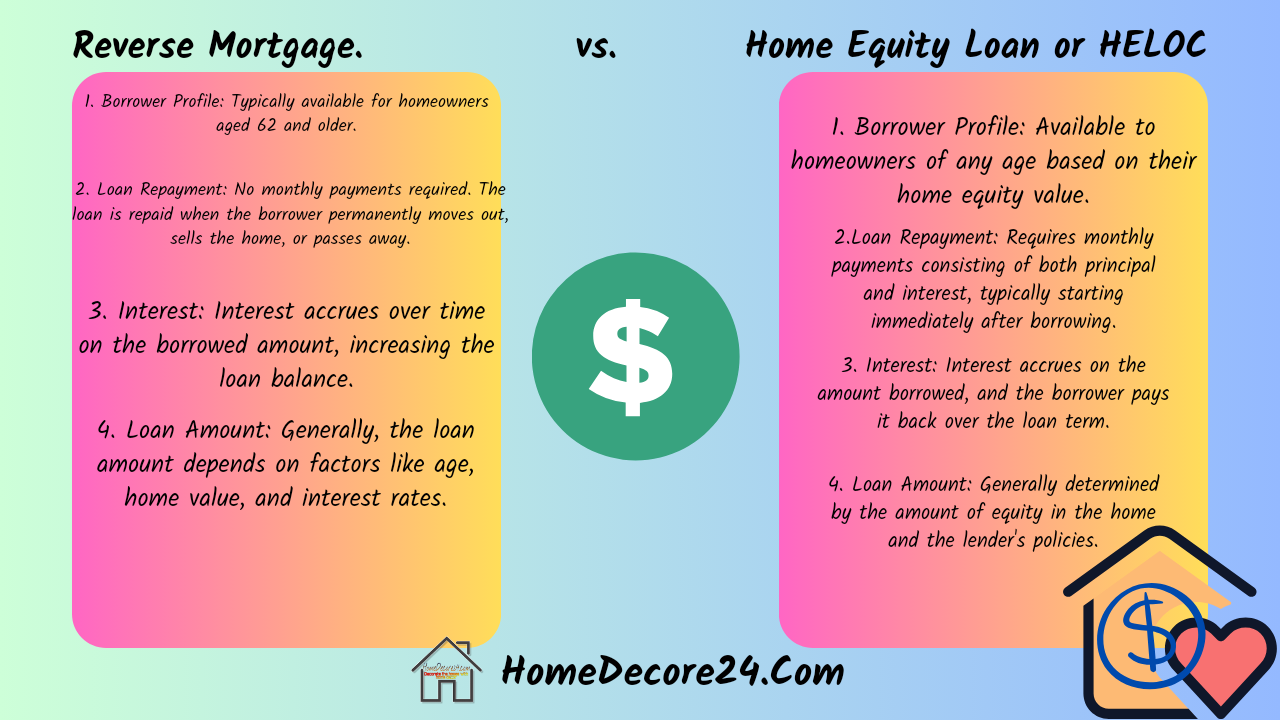

c. Home Equity Loan/Line of Credit: If you already own a property, tap into your home equity to finance your Airbnb rental. This method allows you to leverage an existing asset.

Real Estate Partnerships

Consider forming a partnership with other investors to pool resources and share the financial burden. Partnerships can provide access to larger capital and expertise, spreading both risk and reward.

Read More: Exploring USDA Guaranteed vs. Direct Loans

Airbnb-Specific Financing Options

a. Airbnb Host Guarantee Loan: Airbnb has partnered with lenders to offer financing options exclusively for hosts. These loans are based on your Airbnb income potential and can be a convenient choice.

b. Host Financial Programs: Look into specialized financial programs designed for Airbnb hosts, which can offer tailored loans or credit lines based on your property’s short-term rental potential.

Research Local Grants and Incentives

Some cities or regions offer grants, incentives, or tax breaks for property owners who contribute to the local tourism industry through short-term rentals. Research local government websites or contact economic development offices for potential opportunities.

Prepare a Solid Business Plan

Lenders and potential partners will want to see a well-structured business plan that outlines your property’s income projections, expenses, and strategies for attracting guests. A comprehensive plan increases your credibility and enhances your chances of securing financing.

Bottom Line

Financing an Airbnb rental property requires careful consideration and research. By understanding your financial situation, exploring a range of financing options, and leveraging creative strategies, you can secure the funds needed to invest in your dream rental property. Remember to conduct thorough due diligence, seek professional advice, and create a solid business plan to set yourself up for success in the exciting world of Airbnb hosting.