Mortgages Loan types in USA

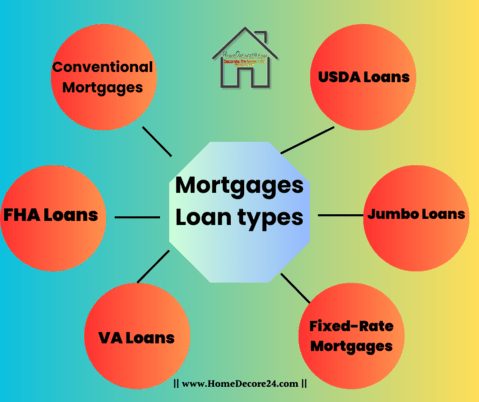

There are several types of mortgage loans available in the USA. Here are some of the most common:

Conventional mortgages: These are not backed by the government and typically require a higher credit score and down payment than government-insured mortgages.

FHA loans: These are insured by the Federal Housing Administration and are designed to make homeownership more accessible to people with lower credit scores or smaller down payments.

VA loans: These are guaranteed by the Department of Veterans Affairs and are available to eligible veterans, active-duty service members, and surviving spouses. They often require no down payment and have lower interest rates than conventional mortgages.

USDA loans: These are backed by the United States Department of Agriculture and are designed to help people in rural areas purchase homes. They often require no down payment and have lower interest rates than conventional mortgages.

Jumbo loans: These are non-conforming loans that exceed the loan limits set by Fannie Mae and Freddie Mac. They are typically used for luxury properties or homes in high-cost areas.

Fixed-rate mortgages: These have a fixed interest rate for the entire term of the loan, making it easier to budget and plan for monthly mortgage payments.

Adjustable-rate mortgages: These have an interest rate that can change over time, based on market conditions. They often start with a lower interest rate than fixed-rate mortgages but can become more expensive over time.

Mortgages are one of the most common ways for people to purchase a home in the United States. A mortgage is a loan that is used to buy a property, and it is usually repaid over a period of 15 to 30 years, depending on the terms of the loan. There are several different types of mortgages available, each with its own advantages and disadvantages.

Types of mortgages

1. Conventional Mortgages

A conventional mortgage is a home loan that is not backed by the government. These loans are often offered by private lenders, such as banks or credit unions. Because they are not insured by the government, conventional mortgages typically require a higher credit score and down payment than government-insured mortgages.

One of the advantages of a conventional mortgage is that it can be used to buy any type of property, including second homes or investment properties. Another advantage is that borrowers can often avoid paying mortgage insurance if they put down a large enough down payment.

2. FHA Loans

FHA loans are insured by the Federal Housing Administration and are designed to make homeownership more accessible to people with lower credit scores or smaller down payments. These loans are often popular with first-time homebuyers, as they can be easier to qualify for than conventional mortgages.

One of the advantages of an FHA loan is that it requires a lower down payment than a conventional mortgage. Borrowers can often put down as little as 3.5% of the purchase price of the home. Another advantage is that the credit score requirements are often lower than for conventional mortgages.

However, FHA loans also require borrowers to pay mortgage insurance, which can add to the cost of the loan. Additionally, there are limits on the amount that borrowers can borrow with an FHA loan, which may make it difficult to purchase a more expensive home.

Also Read: Avoiding Common Mistakes in the Home Loan Application Process

3. VA Loans

VA loans are guaranteed by the Department of Veterans Affairs and are available to eligible veterans, active-duty service members, and surviving spouses. These loans often require no down payment and have lower interest rates than conventional mortgages.

One of the main advantages of a VA loan is that it requires no down payment, which can make it easier for borrowers to purchase a home. Additionally, VA loans often have lower interest rates than conventional mortgages, which can save borrowers money over the life of the loan.

However, VA loans are only available to eligible veterans, active-duty service members, and surviving spouses, so not everyone will qualify for this type of loan. Additionally, there may be limits on the amount that borrowers can borrow with a VA loan.

4. USDA Loans

USDA loans are backed by the United States Department of Agriculture and are designed to help people in rural areas purchase homes. These loans often require no down payment and have lower interest rates than conventional mortgages.

One of the advantages of a USDA loan is that it can be used to purchase a home in a rural area, which may be more affordable than buying a home in a more urban area. Additionally, USDA loans often require no down payment, which can make it easier for borrowers to purchase a home.

However, USDA loans are only available to borrowers who meet certain income requirements and who are purchasing a home in a designated rural area. This may limit the availability of this type of loan for some borrowers.

5. Jumbo Loans

Jumbo loans are non-conforming loans that exceed the loan limits set by Fannie Mae and Freddie Mac. They are typically used for luxury properties or homes in high-cost areas.

One of the advantages of a jumbo loan is that it can be used to purchase a more expensive home than a conventional mortgage. Additionally, jumbo loans often have competitive interest rates, which can save borrowers money over the life of the loan.

However, jumbo loans often require a larger down payment and a higher credit.

How many types of mortgages are there in us?

There are several types of mortgages available in the US, including conventional mortgages, FHA loans, VA loans, USDA loans, jumbo loans, fixed-rate mortgages, and adjustable-rate mortgages, among others.

What are 6 types of mortgage?

- Conventional Mortgages

- FHA Loans

- VA Loans

- USDA Loans

- Jumbo Loans

- Fixed-Rate Mortgages

Related Video

FAQ

Q: What is a mortgage?

A: A mortgage is a loan used to purchase a property, usually repaid over a period of 15 to 30 years.

Q: What are the types of mortgages available in the USA?

A: The types of mortgages available in the USA include conventional mortgages, FHA loans, VA loans, USDA loans, jumbo loans, fixed-rate mortgages, and adjustable-rate mortgages.

Q: What is a conventional mortgage?

A: A conventional mortgage is a home loan that is not backed by the government and typically requires a higher credit score and down payment than government-insured mortgages.

Q: What is an FHA loan?

A: An FHA loan is a home loan that is insured by the Federal Housing Administration and is designed to make homeownership more accessible to people with lower credit scores or smaller down payments.

Q: What is a VA loan?

A: A VA loan is a home loan that is guaranteed by the Department of Veterans Affairs and is available to eligible veterans, active-duty service members, and surviving spouses. It often requires no down payment and has lower interest rates than conventional mortgages.

Q: What is a USDA loan?

A: A USDA loan is a home loan that is backed by the United States Department of Agriculture and is designed to help people in rural areas purchase homes. It often requires no down payment and has lower interest rates than conventional mortgages.

Q: What is a fixed-rate mortgage?

A: A fixed-rate mortgage has a fixed interest rate for the entire term of the loan, making it easier to budget and plan for monthly mortgage payments.

Q: What is an adjustable-rate mortgage?

A: An adjustable-rate mortgage has an interest rate that can change over time, based on market conditions. It often starts with a lower interest rate than fixed-rate mortgages but can become more expensive over time.

Home loan calculator

.

Read More

.

✓ How to decorate a small kitchen

.